Monthly Archives: February 2008

Candidates for 02/29/2008

Here is the list of my candidates for today. I will not trade all of those but will start watching them for short-term reversals.

| Date | Sym | L/S | Close | MA(200) | Vol MA(100) | Reason |

| 20080228 | ACOR | 20.83 | 20.01 | 427068 | 1 |

1. 5 Consecutive down days.

2. Volume is 30% over the 10-day moving average.

3. Volume is 70% over the 30-day moving average.

4. Volume is 50% over the 50-day moving average.

Happy Trading!

Pre-market 2/29/08

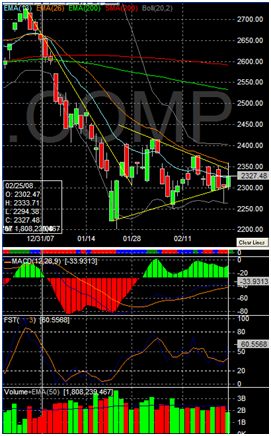

A down day on major indicators of the market today breaking a two day rally. I am taking down my long-term for now. I am sticking to short-term which is from the 60-minutes chart and the intermediate which I get from the daily chart. Please take not these notation are subject to my own interpretation.

The current rally was interrupted by a drop and with the futures down and the news overall negative I think the down movement will extend in tomorrow’s (2/29) trading session.

| Intermediate | Short-term | ||

| NASDAQ | Sideways | Down | |

| Dow | Sideways | Down | |

| S&P | Sideways | Down | |

|

|

||

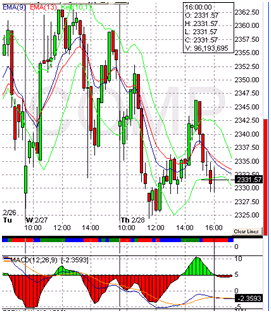

| The NASDAQ is clearly still sideways in a wedge. We will need more then the short rally. | The 60 minute chart of the NASDAQ Composite shows how choppy short term movements can get in these markets. | ||

|

|

||

| I did have to adjust the DOW chart. I left the old wedge line for now but I am looking at rising triangle forming at the moment. This is positive, the symetrical triangle was continuation OR reversal, the rising triangle is more bullish. | The 60-minutes charts again shows how choppy markets get. | ||

|

|

||

| Like with the NASDAQ, the S&P is in the symmetrical triangle (wedge) still. | All three 60-minutes charts pretty much follow each other. I clearly see this down move extending into tomorrow (2/29). | ||

Happy Trading!

links for 2008-02-28

-

Adrienne Toghraie is a trader’s coach. I have not read any of her material but I signed up for her newsletter and will be looking to get my hands on some of her books soon.

Candidates for 02/28/2008

Here is the list of my candidates for today. I will not trade all of those but will start watching them for short-term reversals.

| Date | Sym | L/S | Close | MA(200) | Vol MA(100) | Reason |

| 20080227 | ACOR | 21.96 | 20.02 | 423722 | 1 | |

| 20080227 | JASO | 15.9 | 15.23 | 9097904 | 1 | |

| 20080227 | MA | 191.19 | 169.23 | 3897692 | 1 |

1. 5 Consecutive down days.

2. Volume is 30% over the 10-day moving average.

3. Volume is 70% over the 30-day moving average.

4. Volume is 50% over the 50-day moving average.

Happy Trading!

links for 2008-02-27

-

Excellent post by Trader Eyal. I love these posts about tools. Bloggers tend to post about that only once but really, updated posts are interesting too because things change so fast. In six months, a lot of your tools could be different.

Candidates for 02/27/2008

Here is the list of my candidates for today. I will not trade all of those but will start watching them for short-term reversals.

| Date | Sym | L/S | Close | MA(200) | Vol MA(100) | Reason |

1. 5 Consecutive down days.

2. Volume is 30% over the 10-day moving average.

3. Volume is 70% over the 30-day moving average.

4. Volume is 50% over the 50-day moving average.

Happy Trading!

Pre-market 2/26/08

The end of day Friday rally continued most of the day today on the positive Ambac news. The middle of the trading session showed a little profit taking but overall, indicators closed up 1-2%.

I am keeping my intermediate status sideways at the moment but the Dow and the S&P seems to have poke through the upper boundary of the triangle. So I will be looking for confirmation on that on the upcoming trading sessions.

|

|

Long-term |

Intermediate |

Short-term |

|

NASDAQ |

Down |

Sideways |

Up |

|

Dow |

Down |

Sideways |

Up |

|

S&P |

Down |

Sideways |

Up |

|

|

|

|

The NASDAQ daily chart has not yet broken the wedge. But I don’t think this sideways action can be sustained much longer. |

The 15 minute chart shows the profit taking mid-day but overall a positive close. We are back up to last Wednesday’s levels. |

|

|

|

|

The Dow seem to be breaking the upper boundary of my wedge. It is one indication but it needs a lot more confirmation. We are still in a sideways market, volumes not quite enough to break this at the moment. |

A very similar 15 minutes chart. Profit taking mid-day but an overall positive day. |

|

|

|

|

The S&P seem to also be breaking that wedge so I will look for confirmation here also. The congestion could come to an end soon. Most vacations and other “anchors” are over so I will be looking for volume to increase as people see positive action and want to participate.

|

Another similar 15 minutes chart. Very strong push at the open following Friday’s news. A little profit taking mid-day and positive afternoon trading. I think this should carry into Tuesday with increased volume. |

Happy Trading!