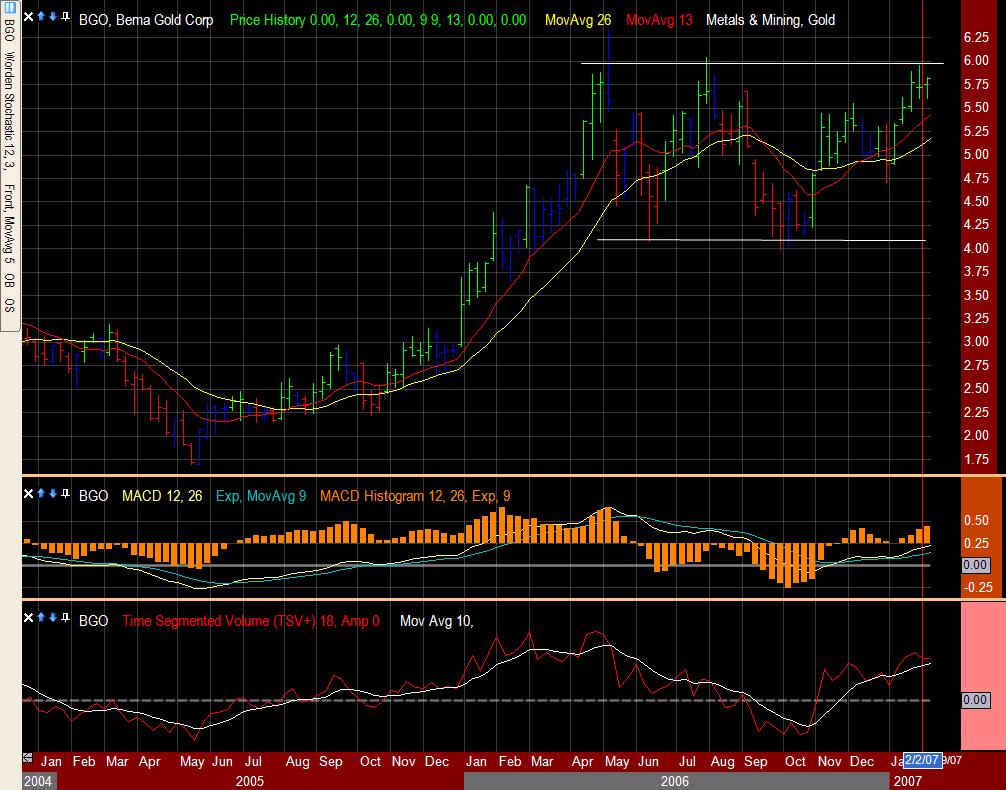

I currently have two possible setups for this. The daily bar just turned from a red impulse signal to green. So we are permitted buying. The end of 2006 also had a small bullish divergence on the MACD histogram. I also noticed the chart traced a hammer four of five bars ago which could mean a change from trading in range to trending. So of course, the first thing to watch out is the breakout through 6, supported by the current positive news on Gold. Whether you would want to take now and hope for a breakout or keep a close eye and wait for it is up to you. Taking it now could allow you 1 or 1.5 points more on the trend but of course, you pay for it in risk. Failing that, we could track BGO back down to around 4 and wait for the bounce on the resistance. It’s like a scratch off, two ways to play!

Happy Trading!