The end of day Friday rally continued most of the day today on the positive Ambac news. The middle of the trading session showed a little profit taking but overall, indicators closed up 1-2%.

I am keeping my intermediate status sideways at the moment but the Dow and the S&P seems to have poke through the upper boundary of the triangle. So I will be looking for confirmation on that on the upcoming trading sessions.

|

|

Long-term |

Intermediate |

Short-term |

|

NASDAQ |

Down |

Sideways |

Up |

|

Dow |

Down |

Sideways |

Up |

|

S&P |

Down |

Sideways |

Up |

|

|

|

|

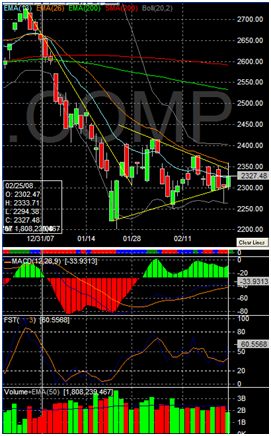

The NASDAQ daily chart has not yet broken the wedge. But I don’t think this sideways action can be sustained much longer. |

The 15 minute chart shows the profit taking mid-day but overall a positive close. We are back up to last Wednesday’s levels. |

|

|

|

|

The Dow seem to be breaking the upper boundary of my wedge. It is one indication but it needs a lot more confirmation. We are still in a sideways market, volumes not quite enough to break this at the moment. |

A very similar 15 minutes chart. Profit taking mid-day but an overall positive day. |

|

|

|

|

The S&P seem to also be breaking that wedge so I will look for confirmation here also. The congestion could come to an end soon. Most vacations and other “anchors” are over so I will be looking for volume to increase as people see positive action and want to participate.

|

Another similar 15 minutes chart. Very strong push at the open following Friday’s news. A little profit taking mid-day and positive afternoon trading. I think this should carry into Tuesday with increased volume. |

Happy Trading!