A mentioned in the previous post, I am currently testing Nozbe. I was always a fan of the Seinfeldian Chain concept and there are neat applications online already but I was resistant to using yet another application or site everyday.

A mentioned in the previous post, I am currently testing Nozbe. I was always a fan of the Seinfeldian Chain concept and there are neat applications online already but I was resistant to using yet another application or site everyday.

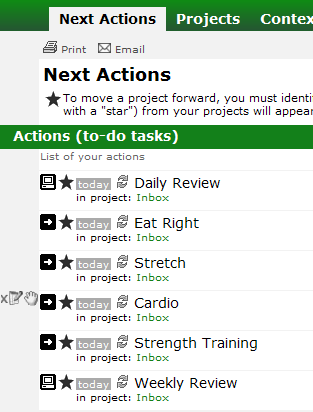

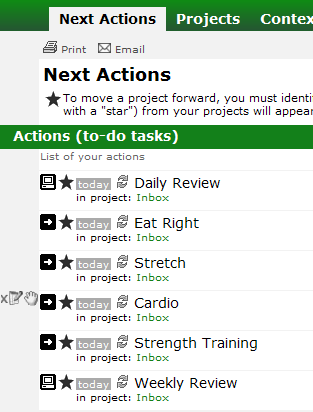

I discovered I could basically use Nozbe for this purpose. All that it really missing is a link to visualize the chain on a calendar but this could probably be added, by Nozbe developer Michael Sliwinski, pretty easily.

A lot of people see an increase productivity when they can track how well they do at certain repetitive tasks. It could personal items like mine (working out, eating right, etc.) or work related items (review days trades for traders for example). Anything that you want to do every day but that you have a tendency to stray away from should be added as a daily repeater to help you reminder. I will submit a request for enhancements hoping Michael can add visual calendars showing you which days you completed the specified Seinfeldian task. It would be a great tool to track your past productivity AND to increase you future success by motivating you to reach better and better ‘daily tasks completion ratios’. I would suggest everyone add in their daily and weekly review an short analysis of how well you did handling these tasks.

These tasks probably belong in their own context but for now, I am using the free version of Nozbe to get an idea of what I can get out of it. Once paid for upgrade, these tasks would either go in their own context (like eat right) or in a related context (like in the gym for cardio). Since I don’t really get my Nozbe lists in the gym (and once I’m there I will more than likely accomplish what I need to do), a specific context for all daily reminders is probably appropriate.

These tasks probably belong in their own context but for now, I am using the free version of Nozbe to get an idea of what I can get out of it. Once paid for upgrade, these tasks would either go in their own context (like eat right) or in a related context (like in the gym for cardio). Since I don’t really get my Nozbe lists in the gym (and once I’m there I will more than likely accomplish what I need to do), a specific context for all daily reminders is probably appropriate.

Good luck with Nozbe and please, if you have comments or advice on Nozbe and how you use it, do not hesitate to share in the comment section of this post or one of the related posts.

Nozbe

Nozbe