I really wished I did this exercise every day. And if I traded full-time, it is definitely something I would do. But as a part-timer, life sometimes takes over and good intentions drop on the wayside. Pre/Post market analysis, diet and exercise and early bed time are the first things to go, but I digress. Knowing if the market went up or down is one thing, but taking 30 to 45 minutes each day to look closely at the charts of market indicators reveals a lot about the current conditions. On top of it, the media bombards us with their analysis of the situation but doing your own really allows you to tie it with your own trading style. I may look into at least making a weekly out of it. But I hope that practicing makes me faster at it, making it easier to integrate in my daily routine.

Weird day today, market was down most of the day but with no real conviction. Lack of interest, snow in NY and plain inertia kept the trend from Thursday going. Things rebounded around 3:30pm mainly on positive news in the financial sector in the form of an Ambac bailout.

I am playing with the layout and the size of the charts, trying to make sure I can produce them quickly but that they are all readable.

|

|

Long-term |

Intermediate |

Short-term |

|

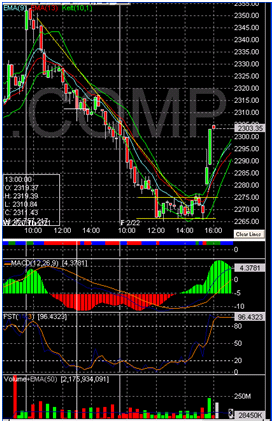

NASDAQ |

Down |

Sideways |

UP* |

|

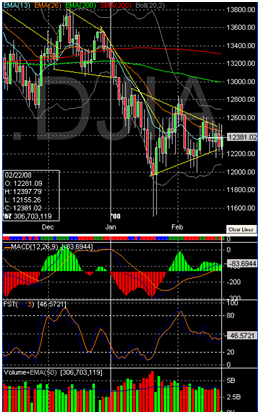

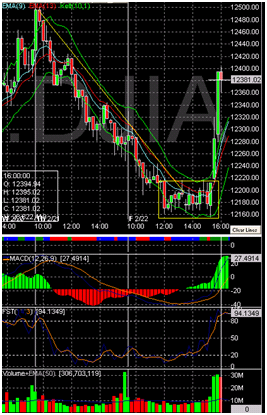

Dow |

Down |

Sideways |

UP* |

|

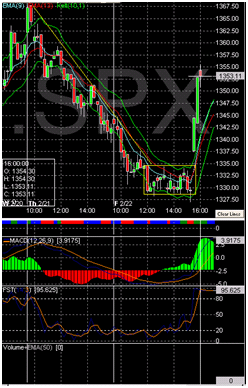

S&P |

Down |

Sideways |

UP* |

|

|

|

|

No big changed on the daily charts. I consider we are still in range and in the triangle until we break an upped boundary. Breaking that recent 2350 high would be a start. |

The first part of the day simply continued the downtrend from yesterday. The market went sideways around noon and broke up near 3:30pm. We saw a little profit taking already right on the last bar so guesses for Monday are hard to make. |

|

|

|

|

The DOW is also still in range. Getting back near 12600 would be a great step out of this range. So far the triangle is still getting narrower, so a big down move, breaking down the bottom of the wedge would worry me. |

The 15min chart followed the day’s pattern. Down until noon and sideways until it broke up at 3:30pm. |

|

|

|

|

On the S&P chart, the wedge seems to be broadening. For the last 3 or 4 bars, the day’s range has been increasing so something is brewing. |

Same pattern on the 15min S&P chart. |