An overall very low volume day. Feels like everyone took a breather and a back seat trying to see where this was going. A complete loss of momentum is not what you want in the middle of what people considered a recovery. As usual, main stream media was very quick at making the last three bars poster boys for bull markets but the reality is not this clear. I guess up and down sells news more than indecision.

Lets look at the daily chart to see where we are:

The DOW is sitting right at 12,530, barely passed the 50 days EMA. We had two strong and long candles but today, we traced a very short candle with low volume. We just barely broke to several key marks on my chart (EMA-50, downtrend line) and we are reaching for two more (EMA-200 and top b-band) but we will not make it with volumes like this. Nothing on the ADX/DMI indicates a trend yet so I still consider us sideways. When sideways I pay more attention to the oscillators and in this case, the Slow Stochastic is getting near overbought. Overall, I am losing a little faith in the current market.

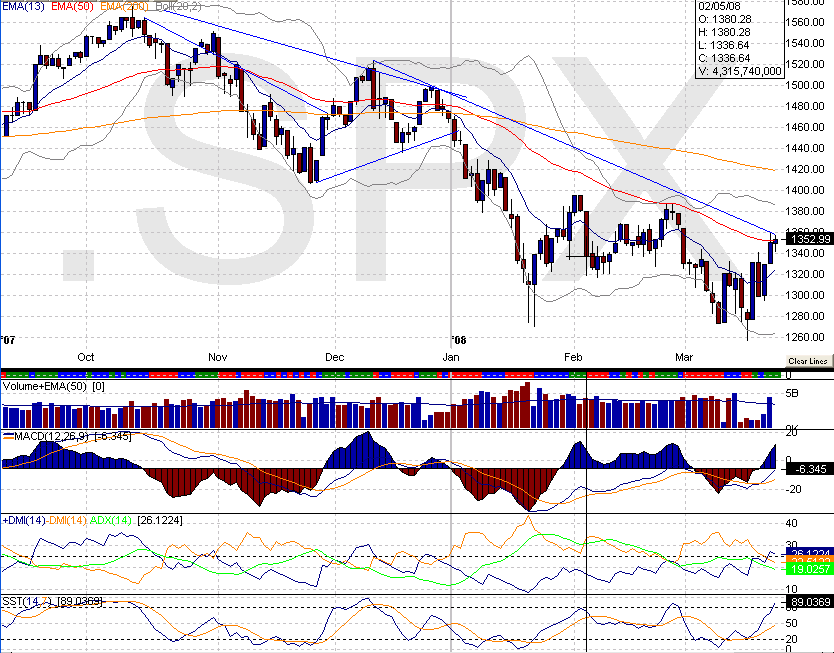

Similar concerns on the SPX:

Dropping volume coming to the trendline and the 50 day EMA is nothing to build confidence in the market. Nothing on the ADX/DMI and Slow Stochastic also getting oversold. We are losing steam.

Lock in some profits on your swings and position trades and keep your stops tight.

Happy Trading!