PageOnce is the first Personal Internet Assistant web site. The site is currently in beta but they expect to be fully open for business soon. The site basically allows you to centralize access to a lot of other sites, making it a great birds eye view of your web tool. Accounts are categorized so you can quickly look at your email accounts (Gmail, Yahoo, etc.), at your financial accounts (Banks, Credit Cards, etc.) or your social sites (myspace, facebook, linkedin, plaxo, multiply and more).

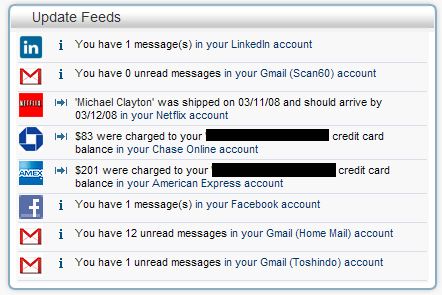

On the main page, the update feed gives you important updates from your various accouts:

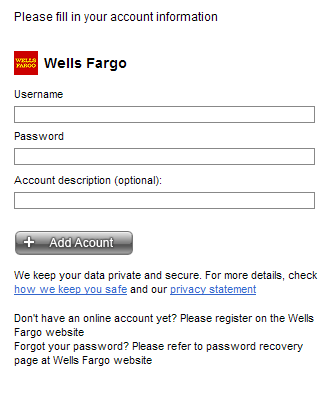

Adding an account is very simple:

And the impressive feature is PageOne will capture keywords from other accounts to suggest new one. A couple of Amazon charges show up on your credit card and PageOnce may recommend added your Amazon account. This is excellent since a lot of these websites I don’t visit a lot and it would take me a while to remember to add them in my personal assistant. It is also convenient since accounts are added constantly, these reminders will help assure all the important onces are listed in PageOnce.

Overall, this new arrival could be a great time saver for busy poeple with a lot of online activity.

Check it out!

Category Archives: reviews

CMO Dip Trip (+0.47)

Traded my first Dip Trip and I am happy with the result. I read “The Master Swing Trader” by Alan Farley several times and still refer to it once in a while. I just never really used his pattern knowingly until now. I started visiting his site recently and he has interesting content. So a couple of days ago, he had listed CMO has a dip trip candidate so I started watching it. Here is the daily chart:

I placed a fib grid on the top of the late November to late January trend. Right after that top, we see the dip starting and it hits bottom around 38.2% as predicted. I started watching the rebound but I was careful. On the hourly chart, I traced a trendline tacking the dip. The line was traced between the top on 1/24 and the congestion levels mid-day on 1/28. Following the action, I saw the price rebound back to that line on 1/30 so I entered. Unfortunately, I miscalculated the impact of the FOMC 3/4 pt rate cut announcement on that Wednesday. At first, the markets rallied so I entered my position after the announcement around 2:45pm, not a time I enter a lot of positions. The rally was short lived and after reading more into Bernanke’s words, the market turned red across the board, taking CMO with it. All through Thursday, the markets were in the red and CMO was falling. I got very close to my stop level but I hung in there and right on the bell Friday morning, the uptrend from Wednesday resumed. Later that afternoon, I had .50pt gains on the trade, it was Friday, and not knowing what the weekend had in store and the market being as volatile as it is now, I cashed out when the price showed signs of congestion later in the day Friday. Looking at the chart now, it’s clear I may have gotten out too early but I sleep better with my money in the bank and Monday I can start looking at other charts.

Hope everyone is having a good Super Bowl weekend. Enjoy the game tomorrow and GO G-MEN!!!

A Nozbe Seinfeldian Chain

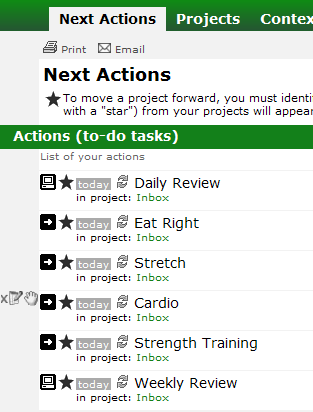

A mentioned in the previous post, I am currently testing Nozbe. I was always a fan of the Seinfeldian Chain concept and there are neat applications online already but I was resistant to using yet another application or site everyday.

A mentioned in the previous post, I am currently testing Nozbe. I was always a fan of the Seinfeldian Chain concept and there are neat applications online already but I was resistant to using yet another application or site everyday.

I discovered I could basically use Nozbe for this purpose. All that it really missing is a link to visualize the chain on a calendar but this could probably be added, by Nozbe developer Michael Sliwinski, pretty easily.

A lot of people see an increase productivity when they can track how well they do at certain repetitive tasks. It could personal items like mine (working out, eating right, etc.) or work related items (review days trades for traders for example). Anything that you want to do every day but that you have a tendency to stray away from should be added as a daily repeater to help you reminder. I will submit a request for enhancements hoping Michael can add visual calendars showing you which days you completed the specified Seinfeldian task. It would be a great tool to track your past productivity AND to increase you future success by motivating you to reach better and better ‘daily tasks completion ratios’. I would suggest everyone add in their daily and weekly review an short analysis of how well you did handling these tasks.

These tasks probably belong in their own context but for now, I am using the free version of Nozbe to get an idea of what I can get out of it. Once paid for upgrade, these tasks would either go in their own context (like eat right) or in a related context (like in the gym for cardio). Since I don’t really get my Nozbe lists in the gym (and once I’m there I will more than likely accomplish what I need to do), a specific context for all daily reminders is probably appropriate.

These tasks probably belong in their own context but for now, I am using the free version of Nozbe to get an idea of what I can get out of it. Once paid for upgrade, these tasks would either go in their own context (like eat right) or in a related context (like in the gym for cardio). Since I don’t really get my Nozbe lists in the gym (and once I’m there I will more than likely accomplish what I need to do), a specific context for all daily reminders is probably appropriate.

Good luck with Nozbe and please, if you have comments or advice on Nozbe and how you use it, do not hesitate to share in the comment section of this post or one of the related posts.

Nozbe

Nozbe (this is an affiliate link) is a web-based project, task and notes management system completely based on the David Allen’s Getting Things Done approach. I heard about this web-based system a while ago and the reviews were very good but I opted against it at the time. At the moment, I am using the GTD AddOn for Outlook but to be honest, I have been using it less and less.

Nozbe (this is an affiliate link) is a web-based project, task and notes management system completely based on the David Allen’s Getting Things Done approach. I heard about this web-based system a while ago and the reviews were very good but I opted against it at the time. At the moment, I am using the GTD AddOn for Outlook but to be honest, I have been using it less and less.

Tim Sykes' An American Hedge Fund

I had pre-ordered Tim Sykes‘ An American Hedge Fund a while back, I received it late September and finally got around to reading it all this weekend.

I had pre-ordered Tim Sykes‘ An American Hedge Fund a while back, I received it late September and finally got around to reading it all this weekend.

Tim is the trader who started Cilantro Fund Partners LP from capital he made on the market. He started trading the $12,415 from his Bar Mitzvah and turned it into $1.65 million between 1999 and 2002, managed his short bias hedge fund from 2003 to 2006 and starred in the TV documentary Wall Street Warriors on MOJO.

Tim’s book was very entertaining. It is loaded with anecdotes about his life, his trading and his decisions. With the trades and the decisions, he took pride in highlighting the good but took no shame is also highlighting the bad. It make the book a great insight into his life and his passion, the stock market.

I did not always agree with Tim’s underlying message on how SEC regulation on hedge fund publicity and advertising can prevent small guys from succeeding. Although it is nice to help smaller players, I think the SEC does have a key role in protecting the general public and the field of investors. But it took nothing away from the book. The last chapter alone, “Lessons Learned”, is a goldmine of facts Tim learned the hard way and is now sharing with the readers.

I would recommend the book to anyone interested in the market. Do not look for precise recipes for success shorting Pink Sheets and Bulletin Board stocks but keep an open mind and you will learn plenty from a fellow trader.

Review of TradingMarkets.com

I just recently ended a trial of TradingMarkets.com, one of the numerous sources of information on the Internet for stock, options and futures traders of all level. Since I mainly focus on stocks at the moment, this review will do the same.

TradingMarkets.com was founded in 1999 by Larry Connors and is headquartered in Los Angeles California. In their own words: “TradingMarket.com is the world’s largest site for traders” and “What separates TradingMarkets.com from all other trading information sources is that the content on our site is written by professional traders with proven track records of success. Our site includes commentary from a roster of top-notch money managers and professional traders that include Kevin Haggerty, Tony Saliba, Mark Boucher, Larry Connors, and Dave Landry.”

Synergy

This post will certainly highlight my ‘tech’ side but I had no choice but to cover this here. This tool has single handedly improved my life, my trading and all my work at the computer in general. Many traders (actually pretty much everyone these days) rely on multiple screens to do their work. Scanning charts, news, websites and what have you requires a lot of screen real estate. In a lot of cases, you can hook up multiple screen on a single cpu but sometimes, you just have to deal with multiple machines. When dealing with multiple machines, I usually see either the user A) switching from keyboard to keyboard trying to work on different machines or B) using a hardware KVM, pressing a button to switch the main keyboard from machine to machine.

This post will certainly highlight my ‘tech’ side but I had no choice but to cover this here. This tool has single handedly improved my life, my trading and all my work at the computer in general. Many traders (actually pretty much everyone these days) rely on multiple screens to do their work. Scanning charts, news, websites and what have you requires a lot of screen real estate. In a lot of cases, you can hook up multiple screen on a single cpu but sometimes, you just have to deal with multiple machines. When dealing with multiple machines, I usually see either the user A) switching from keyboard to keyboard trying to work on different machines or B) using a hardware KVM, pressing a button to switch the main keyboard from machine to machine.

For several months now, I have been using Synergy, a small piece of software, available for free, that virtually binds a single keyboard and mouse to multiple computers, given the computers are connected on a local network.