Last week was a fairly devastating week for bulls. Overall they failed to maintain the support and panic is slowly settling in. We can feel people getting more concerned with the economy and recession with the market taking a hit. Again, the focus is back to the dollar, the price of oil and other economic indicators.

Futures are not down this morning but I doubt there is a lot of conviction in this morning. We could very well see a morning with an open up but the where the bears take control shortly after.

| S&P 500 |

+3.90 |

1296.70 |

3/10 8:31am |

| Fair Value |

|

1293.82 |

3/9 10:15am |

| Difference* |

|

+2.88 |

|

| NASDAQ |

+3.75 |

1712.50 |

3/10 8:30am |

| Fair Value |

|

1708.72 |

3/9 10:15am |

| Difference* |

|

+3.78 |

|

| Dow Jones |

+29.00 |

11920.00 |

3/10 8:01am |

Pasted from <http://money.cnn.com/data/premarket/index.html>

|

Intermediate |

Short-term |

| Dow |

Sideways |

Down |

| NASDAQ |

Sideways |

Down |

| S&P |

Sideways |

Down |

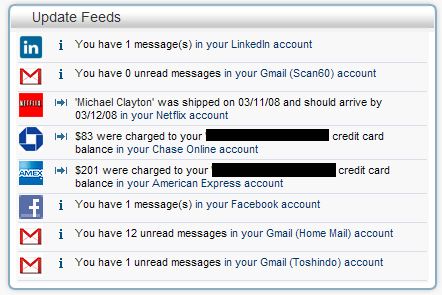

Taking a look at HardRightEdge, Alan Farley had an interesting comment about volatility:

“VIX is undermining the odds for a near-term washout because it still hasn’t broken above 30. The January reversal came near 38, which indicates we’re still not close to a real climax.” Pasted from <http://www.hardrightedge.com/trader.htm>

To illustrate his point, here is a chart of the VIX:

And the DOW for the same period:

And for the market review, only DOW charts today:

|

|

|

| We are now clearly getting close and closer to the January lows. Once the VIX reaches near mid-30s, we will be in a better position to expect a reversal. |

The short-term trend is fairly obvious. Last week was not a good week for bulls. |

Happy Trading!